Activity: Taxes

Total instructions: 407

Instructions (407)

- Taxes

- English

- Internal Revenue Service

Form 1023 Instructions

Instructions for Form 1023, Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code

- Taxes

- English

- Internal Revenue Service

Form 1023-EZ Instructions

Instructions for Form 1023-EZ, Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code

- Taxes

- English

- Internal Revenue Service

Form 1024 Instructions

Instructions for Form 1024, Application for Recognition of Exemption Under Section 501(a) or Section 521 of the Internal Revenue Code

- Taxes

- English

- Internal Revenue Service

Form 1024-A Instructions

Instructions for Form 1024-A, Application for Recognition of Exemption Under Section 501(c)(4) of the Internal Revenue Code

- Taxes

- English

- Internal Revenue Service

Form 1028 Instructions

Instructions for Form 1028, Application for Recognition of Exemption Under Section 521 of the Internal Revenue Code

- Taxes

- English

- Internal Revenue Service

Form 1040 and 1040-SR Instructions

Instructions for Form 1040 or Form 1040-SR, U.S. Individual Income Tax Return

- Taxes

- Internal Revenue Service

- Spanish

Form 1040 Instructions (Puerto Rican Version)

Instructions for Form 1040 (PR), Federal Self-Employment Contribution Statement for Residents of Puerto Rico

- Taxes

- Internal Revenue Service

- Spanish

Form 1040 Instructions (Spanish Version)

Instructions for Form 1040 and Form 1040-SR (Spanish version)

- Taxes

- English

- Internal Revenue Service

Form 1040 Instructions for Schedule 8812

Instructions for Schedule 8812, Credits for Qualifying Children and Other Dependents

- Taxes

- Internal Revenue Service

- Spanish

Form 1040 Instructions for Schedule 8812 (Spanish Version)

Instructions for Form 1040 Schedule 8812, Credits for Qualifying Children and Other Dependents (Spanish Version)

- Taxes

- Internal Revenue Service

- Spanish

Form 1040 Instructions for Schedule H (Puerto Rican Version)

Instrucciones para el Anexo H-PR, Contribuciones sobre el Empleo de Empleados Domésticos

- Taxes

- English

- Internal Revenue Service

Form 1040 Instructions for Schedule LEP

Instructions for Schedule LEP (Form 1040), Request for Change in Language Preference

- Taxes

- English

- Internal Revenue Service

Form 1040 Instructions for Schedule R

Instructions for Schedule R (Form 1040 or Form 1040-SR), Credit for the Elderly or the Disabled

- Taxes

- English

- Internal Revenue Service

Form 1040 Instructions for Schedule SE

Instructions for Schedule SE (Form 1040 or Form 1040-SR), Self-Employment Tax

- Taxes

- English

- Internal Revenue Service

Form 1040 Instructions for Tax and Earned Income Credit Tables

Tax Table, Tax Computation Worksheet, and EIC Table

- Taxes

- English

- Internal Revenue Service

Form 1040 Schedule A Instructions

Instructions for Schedule A (Form 1040 or Form 1040-SR), Itemized Deductions

- Taxes

- English

- Internal Revenue Service

Form 1040 Schedule B Instructions

Instructions for Schedule B (Form 1040 or Form 1040-SR), Interest and Ordinary Dividends

- Taxes

- English

- Internal Revenue Service

Form 1040 Schedule C Instructions

Instructions for Schedule C (Form 1040 or Form 1040-SR), Profit or Loss From Business (Sole Proprietorship)

- Taxes

- English

- Internal Revenue Service

Form 1040 Schedule D Instructions

Instructions for Schedule D (Form 1040 or Form 1040-SR), Capital Gains and Losses

- Taxes

- English

- Internal Revenue Service

Form 1040 Schedule E Instructions

Instructions for Schedule E (Form 1040 or Form 1040-SR), Supplemental Income and Loss

- Taxes

- English

- Internal Revenue Service

Form 1040 Schedule F Instructions

Instructions for Schedule F (Form 1040 or Form 1040-SR), Profit or Loss From Farming

- Taxes

- English

- Internal Revenue Service

Form 1040 Schedule H Instructions

Instructions for Schedule H (Form 1040 or Form 1040-SR), Household Employment Taxes

- Taxes

- English

- Internal Revenue Service

Form 1040 Schedule J Instructions

Instructions for Schedule J (Form 1040 or Form 1040-SR), Income Averaging for Farmers and Fishermen

- Taxes

- English

- Internal Revenue Service

Form 1040-C Instructions

Instructions for Form 1040-C, U.S. Departing Alien Income Tax Return

- Taxes

- English

- Internal Revenue Service

Form 1040-NR Instructions

Instructions for Form 1040-NR, U.S. Nonresident Alien Income Tax Return

- Taxes

- English

- Internal Revenue Service

Form 1040-NR Instructions (Spanish Version)

Instructions for Form 1040-NR, U.S. Nonresident Alien Income Tax Return (Spanish Version)

- Taxes

- English

- Internal Revenue Service

Form 1040-SS Instructions

Instructions for Form 1040-SS, U.S. Self-Employment Tax Return (Including the Refundable Child Tax Credit for Bona Fide Residents of Puerto Rico)

- Taxes

- English

- Internal Revenue Service

Form 1040-X Instructions

Instructions for Form 1040-X, Amended U.S. Individual Income Tax Return

- Taxes

- English

- Internal Revenue Service

Form 1041 Schedule A, B, G, J and K-1 Instructions

Instructions for Form 1041, U.S. Income Tax Return for Estates and Trusts, and Schedules A, B, G, J, and K-1

- Taxes

- English

- Internal Revenue Service

Form 1041 Schedule D Instructions

Instructions for Schedule D (Form 1041), Capital Gains and Losses

- Taxes

- English

- Internal Revenue Service

Form 1041 Schedule I Instructions

Instructions for Schedule I (Form 1041), Alternative Minimum Tax„Estates and Trusts

- Taxes

- English

- Internal Revenue Service

Form 1041 Schedule K-1 Instructions

Instructions for Schedule K-1 (Form 1041) for a Beneficiary Filing Form 1040

- Taxes

- English

- Internal Revenue Service

Form 1041-N Instructions

Instructions for Form 1041-N, U.S. Income Tax Return for Electing Alaska Native Settlement Trusts

- Taxes

- English

- Internal Revenue Service

Form 1041-QFT Instructions

U.S. Income Tax Return for Qualified Funeral Trusts

- Taxes

- English

- Internal Revenue Service

Form 1042 Instructions

Instructions for Form 1042 , Annual Withholding Tax Return for U.S. Source Income of Foreign Persons

- Taxes

- English

- Internal Revenue Service

Form 1042-S Instructions

Instructions for Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding

- Taxes

- English

- Internal Revenue Service

Form 1045 Instructions

Instructions for Form 1045, Application for Tentative Refund

- Taxes

- English

- Internal Revenue Service

Form 1065 Instructions

Instructions for Form 1065 , U.S. Return of Partnership Income

- Taxes

- English

- Internal Revenue Service

Form 1065 Instructions for Schedule B-2

Instructions for Form 1065 (Schedule B-2), Election Out of Partnership Level Tax Treatment

- Taxes

- English

- Internal Revenue Service

Form 1065 Instructions for Schedule C

Instructions for Schedule C (Form 1065), Additional Information for Schedule M-3 Filers

- Taxes

- English

- Internal Revenue Service

Form 1065 Instructions for Schedule D

Instructions for Schedule D (Form 1065) , Capital Gains and Losses

- Taxes

- English

- Internal Revenue Service

Form 1065 Instructions for Schedule K-1

Instructions for Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc.

- Taxes

- English

- Internal Revenue Service

Form 1065 Instructions for Schedule K-3

Partner's Instructions for Schedule K-3 (Form 1065), Partner's Share of Income, Deductions, Credits, etc.„International (For Partner's Use Only)

- Taxes

- English

- Internal Revenue Service

Form 1065 Instructions for Schedule M-3

Instructions for Schedule M-3 (Form 1065), Net Income (Loss) Reconciliation for Certain Partnerships

- Taxes

- English

- Internal Revenue Service

Form 1065 Instructions for Schedules K-2 and K-3

Instructions for Schedules K-2 and K-3 (Form 1065)

- Taxes

- English

- Internal Revenue Service

Form 1065-X Instructions

Instructions for Form 1065-X, Amended Return or Administrative Adjustment Request (AAR)

- Taxes

- English

- Internal Revenue Service

Form 1066 Instructions

Instructions for Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return

- Taxes

- English

- Internal Revenue Service

Form 1095-A Instructions

Instructions for Form 1095-A , Health Insurance Marketplace Statement

- Taxes

- English

- Internal Revenue Service

Form 1097-BTC Instructions

Instructions for Form 1097-BTC, Bond Tax Credit

- Taxes

- English

- Internal Revenue Service

Form 1098 Instructions

Instructions for Form 1098, Mortgage Interest Statement

- Taxes

- English

- Internal Revenue Service

Form 1098-C Instructions

Instructions for Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes

- Taxes

- English

- Internal Revenue Service

Form 1098-F Instructions

Instructions for Form 1098-F, Fines, Penalties, and Other Amounts

- Taxes

- English

- Internal Revenue Service

Form 1098-Q Instructions

Instructions for Form 1098-Q, Qualifying Longevity Annuity Contract Information

- Taxes

- English

- Internal Revenue Service

Form 1099-B Instructions

Instructions for Form 1099-B, Proceeds From Broker and Barter Exchange Transactions

- Taxes

- English

- Internal Revenue Service

Form 1099-CAP Instructions

Instructions for Form 1099-CAP, Changes in Corporate Control and Capital Structure

- Taxes

- English

- Internal Revenue Service

Form 1099-DIV Instructions

Instructions for Form 1099-DIV, Dividends and Distributions

- Taxes

- English

- Internal Revenue Service

Form 1099-G Instructions

Instructions for Form 1099-G, Certain Government Payments

- Taxes

- English

- Internal Revenue Service

Form 1099-H Instructions

Instructions for Form 1099-H, Health Coverage Tax Credit (HCTC) Advance Payments

- Taxes

- English

- Internal Revenue Service

Form 1099-K Instructions

Instructions for Form 1099-K, Payment Card and Third Party Network Transactions

- Taxes

- English

- Internal Revenue Service

Form 1099-LS Instructions

Instructions for Form 1099-LS, Reportable Life Insurance Sale

- Taxes

- English

- Internal Revenue Service

Form 1099-LTC Instructions

Instructions for Form 1099-LTC, Long-Term Care and Accelerated Death Benefits

- Taxes

- English

- Internal Revenue Service

Form 1099-PATR Instructions

Instructions for Form 1099-PATR, Taxable Distributions Received From Cooperatives

- Taxes

- English

- Internal Revenue Service

Form 1099-Q Instructions

Instructions for Form 1099-Q, Payments From Qualified Education Programs (Under Sections 529 and 530)

- Taxes

- English

- Internal Revenue Service

Form 1099-S Instructions

Instructions for Form 1099-S, Proceeds From Real Estate Transactions

- Taxes

- English

- Internal Revenue Service

Form 1099-SB Instructions

Instructions for Form 1099-SB, Seller's Investment in Life Insurance Contract

- Taxes

- English

- Internal Revenue Service

Form 1116 Instructions

Instructions for Form 1116, Foreign Tax Credit (Individual, Estate, or Trust)

- Taxes

- English

- Internal Revenue Service

Form 1116 Instructions for Schedule B

Instructions for Schedule B (Form 1116), Foreign Tax Carryover Reconciliation Schedule

- Taxes

- English

- Internal Revenue Service

Form 1116 Instructions for Schedule C

Instructions for Schedule C (Form 1116), Foreign Tax Redeterminations

- Taxes

- English

- Internal Revenue Service

Form 1118 Instructions

Instructions for Form 1118, Foreign Tax Credit„Corporations

- Taxes

- English

- Internal Revenue Service

Form 1118 Instructions for Schedule J

Instructions for Schedule J (Form 1118)

- Taxes

- English

- Internal Revenue Service

Form 1118 Instructions for Schedule K

Instructions for Schedule K (Form 1118)

- Taxes

- English

- Internal Revenue Service

Form 1118 Instructions for Schedule L

Instructions for Schedule L (Form 1118)

- Taxes

- English

- Internal Revenue Service

Form 1120 Instructions

Instructions for Form 1120, U.S. Corporation Income Tax Return

- Taxes

- English

- Internal Revenue Service

Form 1120 Instructions for Schedule D

Instructions for Schedule D (Form 1120), Capital Gains and Losses

- Taxes

- English

- Internal Revenue Service

Form 1120 Instructions for Schedule M-3

Instructions for Schedule M-3 (Form 1120), Net Income (Loss) Reconciliation for Corporations With Total Assets of $10 Million or More

- Taxes

- English

- Internal Revenue Service

Form 1120 Instructions for Schedule O

Instructions for Schedule O (Form 1120), Consent Plan and Apportionment Schedule for a Controlled Group

- Taxes

- English

- Internal Revenue Service

Form 1120 Instructions for Schedule PH

Instructions for Schedule PH (Form 1120), U.S. Personal Holding Company (PHC) Tax

- Taxes

- English

- Internal Revenue Service

Form 1120 Instructions for Schedule UTP

Instructions for Schedule UTP (Form 1120), Uncertain Tax Position Statement

- Taxes

- English

- Internal Revenue Service

Form 1120-C Instructions

Instructions for Form 1120-C, U.S. Income Tax Return for Cooperative Associations

- Taxes

- English

- Internal Revenue Service

Form 1120-F Instructions

Instructions for Form 1120-F, U.S. Income Tax Return of a Foreign Corporation

- Taxes

- English

- Internal Revenue Service

Form 1120-F Instructions for Schedule H

Instructions for Schedule H (Form 1120-F), Deductions Allocated to Effectively Connected Income Under Regulations Section 1.861-8

- Taxes

- English

- Internal Revenue Service

Form 1120-F Instructions for Schedule I

Instructions for Schedule I (Form 1120-F), Interest Expense Allocation Under Regulations Section 1.882-5

- Taxes

- English

- Internal Revenue Service

Form 1120-F Instructions for Schedule M-3

Instructions for Schedule M-3 (Form 1120-F), Net Income (Loss) Reconciliation for Foreign Corporations with Reportable Assets of $10 Million or More

- Taxes

- English

- Internal Revenue Service

Form 1120-F Instructions for Schedule P

Instructions for Schedule P (Form 1120-F), List of Foreign Partner Interests in Partnerships

- Taxes

- English

- Internal Revenue Service

Form 1120-F Instructions for Schedule S

Instructions for Schedule S (Form 1120-F) , Exclusion of Income From the International Operation of Ships or Aircraft Under Section 883

- Taxes

- English

- Internal Revenue Service

Form 1120-F Instructions for Schedule V

Instructions for Schedule V (Form 1120-F), List of Vessels or Aircraft, Operators, and Owners

- Taxes

- English

- Internal Revenue Service

Form 1120-FSC Instructions

Instructions for Form 1120-FSC, U.S. Income Tax Return of a Foreign Sales Corporation

- Taxes

- English

- Internal Revenue Service

Form 1120-H Instructions

Instructions for Form 1120-H, U.S. Income Tax Return for Homeowners Associations

- Taxes

- English

- Internal Revenue Service

Form 1120-IC-DISC Instructions

Instructions for Form 1120-IC-DISC, Interest Charge Domestic International Sales Corporation Return

- Taxes

- English

- Internal Revenue Service

Form 1120-L Instructions

Instructions for Form 1120-L, U.S. Life Insurance Company Income Tax Return

- Taxes

- English

- Internal Revenue Service

Form 1120-L Instructions for Schedule M-3

Instructions for Schedule M-3 (Form 1120-L), Net Income (Loss) Reconciliation for U.S. Life Insurance Companies With Total Assets of $10 Million or More

- Taxes

- English

- Internal Revenue Service

Form 1120-ND Instructions

Instructions for Form 1120-ND, Return for Nuclear Decommissioning Funds and Certain Related Persons

- Taxes

- English

- Internal Revenue Service

Form 1120-PC Instructions

Instructions for Form 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return

- Taxes

- English

- Internal Revenue Service

Form 1120-PC Instructions for Schedule M-3

Instructions for Schedule M-3 (Form 1120-PC), Net Income (Loss) Reconciliation for U.S. Property and Casualty Insurance Companies With Total Assets of $10 Million or More

- Taxes

- English

- Internal Revenue Service

Form 1120-REIT Instructions

Instructions for Form 1120-REIT, U.S. Income Tax Return for Real Estate Investment Trusts

- Taxes

- English

- Internal Revenue Service

Form 1120-RIC Instructions

Instructions for Form 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies

- Taxes

- English

- Internal Revenue Service

Form 1120-S Instructions

Instructions for Form 1120-S, U.S. Income Tax Return for an S Corporation

- Taxes

- English

- Internal Revenue Service

Form 1120-S Instructions for Schedule D

Instructions for Schedule D (Form 1120-S), Capital Gains and Losses and Built-in Gains

- Taxes

- English

- Internal Revenue Service

Form 1120-S Instructions for Schedule K-1

Shareholder's Instructions for Schedule K-1 (Form 1120-S), Shareholder's Share of Income, Deductions, Credits, etc. (For Shareholder's Use Only)

- Taxes

- English

- Internal Revenue Service

Form 1120-S Instructions for Schedule K-3

Shareholder's Instructions for Schedule K-3 (Form 1120-S) , Shareholder's Share of Income, Deductions, Credits, etc.„International (For Shareholder's Use Only)

- Taxes

- English

- Internal Revenue Service

Form 1120-S Instructions for Schedule M-3

Instructions for Schedule M-3 (Form 1120-S), Net Income (Loss) Reconciliation for S Corporations With Total Assets of $10 Million or More

- Taxes

- English

- Internal Revenue Service

Form 1120-S Instructions for Schedules K-2 and K-3

S Corporation Instructions for Schedules K-2 and K-3 (Form 1120-S), Shareholders' Pro Rata Share Items„International and Shareholder's Share of Income, Deductions, Credits, etc.„International

- Taxes

- English

- Internal Revenue Service

Form 1120-SF Instructions

Instructions for Form 1120-SF, U.S. Income Tax Return for Settlement Funds

- Taxes

- English

- Internal Revenue Service

Form 1120-W Instructions

Instructions for Form 1120-W

- Taxes

- English

- Internal Revenue Service

Form 1125-E Instructions

Instructions for Form 1125-E, Compensation of Officers

- Taxes

- English

- Internal Revenue Service

Form 1128 Instructions

Instructions for Form 1128, Application To Adopt, Change, or Retain a Tax Year

- Taxes

- English

- Internal Revenue Service

Form 1139 Instructions

Instructions for Form 1139, Corporation Application for Tentative Refund

- Taxes

- English

- Internal Revenue Service

Form 2106 Instructions

Instructions for Form 2106, Employee Business Expenses

- Taxes

- English

- Internal Revenue Service

Form 2210 Instructions

Instructions for Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts

- Taxes

- English

- Internal Revenue Service

Form 2210-F Instructions

Instructions for Form 2210-F, Underpayment of Estimated Tax by Farmers and Fishermen

- Taxes

- English

- Internal Revenue Service

Form 2220 Instructions

Instructions for Form 2220, Underpayment of Estimated Tax by Corporations

- Taxes

- English

- Internal Revenue Service

Form 2290 Instructions

Instructions for Form 2290, Heavy Highway Vehicle Use Tax Return

- Taxes

- English

- Internal Revenue Service

Form 2441 Instructions

Instructions for Form 2441, Child and Dependent Care Expenses

- Taxes

- English

- Internal Revenue Service

Form 2553 Instructions

Instructions for Form 2553, (For use with the December 2017 revision of Form 2553, Election by a Small Business Corporation)

- Taxes

- English

- Internal Revenue Service

Form 2555 Instructions

Instructions for Form 2555, Foreign Earned Income

- Taxes

- English

- Internal Revenue Service

Form 2848 Instructions

Instructions for Form 2848, Power of Attorney and Declaration of Representative

- Taxes

- English

- Internal Revenue Service

Form 3115 Instructions

Instructions for Form 3115, Application for Change in Accounting Method

- Taxes

- English

- Internal Revenue Service

Form 3468 Instructions

Instructions for Form 3468, Investment Credit

- Taxes

- English

- Internal Revenue Service

Form 3520 Instructions

Instructions for Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts

- Taxes

- English

- Internal Revenue Service

Form 3520-A Instructions

Instructions for Form 3520-A, Annual Information Return of Foreign Trust With a U.S. Owner

- Taxes

- English

- Internal Revenue Service

Form 3800 Instructions

Instructions for Form 3800, General Business Credit

- Taxes

- English

- Internal Revenue Service

Form 3903 Instructions

Instructions for Form 3903, Moving Expenses

- Taxes

- English

- Internal Revenue Service

Form 4136 Instructions

Instructions for Form 4136, Credit for Federal Tax Paid on Fuels

- Taxes

- English

- Internal Revenue Service

Form 4255 Instructions

Instructions for Form 4255, Recapture of Investment Credit

- Taxes

- English

- Internal Revenue Service

Form 4506-A Instructions

Instructions for Form 4506-A, Request for a Copy of Exempt or Political Organization IRS Form

- Taxes

- English

- Internal Revenue Service

Form 4506-B Instructions

Instructions for Form 4506-B, Request for a Copy of Exempt Organization IRS Application or Letter

- Taxes

- English

- Internal Revenue Service

Form 4562 Instructions

Instructions for Form 4562, Depreciation and Amortization (Including Information on Listed Property)

- Taxes

- English

- Internal Revenue Service

Form 461 Instructions

Instructions for Form 461, Limitation on Business Losses

- Taxes

- English

- Internal Revenue Service

Form 4684 Instructions

Instructions for Form 4684, Casualties and Thefts

- Taxes

- English

- Internal Revenue Service

Form 4720 Instructions

Instructions for Form 4720, Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code

- Taxes

- English

- Internal Revenue Service

Form 4768 Instructions

Instructions for Form 4768, Application for Extension of Time To File a Return and/or Pay U.S. Estate (and Generation-Skipping Transfer) Taxes

- Taxes

- English

- Internal Revenue Service

Form 4797 Instructions

Instructions for Form 4797, Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2))

- Taxes

- English

- Internal Revenue Service

Form 5227 Instructions

Instructions for Form 5227, Split-Interest Trust Information Return

- Taxes

- English

- Internal Revenue Service

Form 5300 Instructions

Instructions for Form 5300, Application for Determination for Employee Benefit Plan

- Taxes

- English

- Internal Revenue Service

Form 5307 Instructions

Instructions for Form 5307, Application for Determination for Adopters of Modified Volume Submitter (VS) Plans

- Taxes

- English

- Internal Revenue Service

Form 5310 Instructions

Instructions for Form 5310, Application for Determination for Terminating Plan

- Taxes

- English

- Internal Revenue Service

Form 5310-A Instructions

Instructions for Form 5310-A, Notice of Plan Merger or Consolidation, Spinoff, or Transfer of Plan Assets or Liabilities; Notice of Qualified Separate Lines of Business

- Taxes

- English

- Internal Revenue Service

Form 5316 Instructions

Instructions for Form 5316, Application for Group or Pooled Trust Ruling

- Taxes

- English

- Internal Revenue Service

Form 5329 Instructions

Instructions for Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts

- Taxes

- English

- Internal Revenue Service

Form 5330 Instructions

Instructions for Form 5330, Return of Excise Taxes Related to Employee Benefit Plans

- Taxes

- English

- Internal Revenue Service

Form 5405 Instructions

Instructions for Form 5405, Repayment of the First-Time Homebuyer Credit

- Taxes

- English

- Internal Revenue Service

Form 5471 Instructions

Instructions for Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations

- Taxes

- English

- Internal Revenue Service

Form 5472 Instructions

Instructions for Form 5472, Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business

- Taxes

- English

- Internal Revenue Service

Form 5498-ESA Instructions

Instructions for Form 5498-ESA, Coverdell ESA Contribution Information

- Taxes

- English

- Internal Revenue Service

Form 5500-EZ Instructions

Instructions for Form 5500-EZ, Annual Return of A One-Participant (Owners/Partners and Their Spouses) Retirement Plan or A Foreign Plan

- Taxes

- English

- Internal Revenue Service

Form 56 Instructions

Instructions for Form 56, Notice Concerning Fiduciary Relationship

- Taxes

- English

- Internal Revenue Service

Form 5695 Instructions

Instructions for Form 5695, Residential Energy Credits

- Taxes

- English

- Internal Revenue Service

Form 5713 Instructions

Instructions for Form 5713, International Boycott Report

- Taxes

- English

- Internal Revenue Service

Form 5735 Instructions

Instructions for Form 5735, American Samoa Economic Development Credit

- Taxes

- English

- Internal Revenue Service

Form 5884 Instructions

Instructions for Form 5884, Work Opportunity Credit

- Taxes

- English

- Internal Revenue Service

Form 5884-A Instructions

Instructions for Form 5884-A, Employee Retention Credit for Employers Affected by Qualified Disasters

- Taxes

- English

- Internal Revenue Service

Form 5884-D Instructions

Instructions for Form 5884-D, Employee Retention Credit for Certain Tax-Exempt Organizations Affected by Qualified Disasters

- Taxes

- English

- Internal Revenue Service

Form 6069 Instructions

Instructions for Form 6069, Return of Certain Excise Taxes on Mine Operators, Black Lung Trusts, and Other Persons Under Sections 4951, 4952, and 4953

- Taxes

- English

- Internal Revenue Service

Form 6198 Instructions

Instructions for Form 6198, At-Risk Limitations For use with Form 6198 (Rev. November 2009) or later revision

- Taxes

- English

- Internal Revenue Service

Form 6251 Instructions

Instructions for Form 6251, Alternative Minimum Tax„Individuals

- Taxes

- English

- Internal Revenue Service

Form 6478 Instructions

Instructions for Form 6478, Biofuel Producer Credit

- Taxes

- English

- Internal Revenue Service

Form 6627 Instructions

Instructions for Form 6627, Environmental Taxes

- Taxes

- English

- Internal Revenue Service

Form 6765 Instructions

Instructions for Form 6765, Credit for Increasing Research Activities

- Taxes

- English

- Internal Revenue Service

Form 7004 Instructions

Instructions for Form 7004 , Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns

- Taxes

- English

- Internal Revenue Service

Form 706 Instructions

Instructions for Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return

- Taxes

- English

- Internal Revenue Service

Form 706-A Instructions

Instructions for Form 706-A, United States Additional Estate Tax Return

- Taxes

- English

- Internal Revenue Service

Form 706-GS(D-1) Instructions

Instructions for Form 706-GS(D-1), Notification of Distribution From a Generation-Skipping Trust

- Taxes

- English

- Internal Revenue Service

Form 706-GS(D) Instructions

Instructions for Form 706-GS(D), Generation-Skipping Transfer Tax Return for Distributions

- Taxes

- English

- Internal Revenue Service

Form 706-GS(T) Instructions

Instructions for Form 706-GS(T), Generation-Skipping Transfer Tax Return for Terminations

- Taxes

- English

- Internal Revenue Service

Form 706-NA Instructions

Instructions for Form 706-NA, United States Estate (and Generation-Skipping Transfer) Tax Return (Estate of nonresident not a citizen of the U.S.)

- Taxes

- English

- Internal Revenue Service

Form 706-QDT Instructions

Instructions for Form 706-QDT, U.S. Estate Tax Return for Qualified Domestic Trusts

- Taxes

- English

- Internal Revenue Service

Form 709 Instructions

Instructions for Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return

- Taxes

- English

- Internal Revenue Service

Form 720 Instructions

Instructions for Form 720, Quarterly Federal Excise Tax Return

- Taxes

- English

- Internal Revenue Service

Form 720-CS Instructions

Instructions for Form 720-CS, Carrier Summary Report

- Taxes

- English

- Internal Revenue Service

Form 720-TO Instructions

Instructions for Form 720-TO, Terminal Operator Report

- Taxes

- English

- Internal Revenue Service

Form 7200 Instructions

Instructions for Form 7200, Advance Payment of Employer Credits Due to COVID-19

- Taxes

- Internal Revenue Service

- Spanish

Form 7200 Instructions (Spanish Version)

Instructions for Form 7200, Advance Payment of Employer Credits Due to COVID-19 (Spanish Version)

- Taxes

- English

- Internal Revenue Service

Form 7203 Instructions

Instructions for Form 7203, S Corporation Shareholder Stock and Debt Basis Limitations

- Taxes

- English

- Internal Revenue Service

Form 8023 Instructions

Instructions for Form 8023, Elections Under Section 338 for Corporations Making Qualified Stock Purchases

- Taxes

- English

- Internal Revenue Service

Form 8027 Instructions

Instructions for Form 8027, Employer's Annual Information Return of Tip Income and Allocated Tips

- Taxes

- English

- Internal Revenue Service

Form 8038 Instructions

Instructions for Form 8038, Information Return for Tax-Exempt Private Activity Bond Issues

- Taxes

- English

- Internal Revenue Service

Form 8038-B Instructions

Instructions for Form 8038-B, Information Return for Build America Bonds and Recovery Zone Economic Development Bonds

- Taxes

- English

- Internal Revenue Service

Form 8038-CP Instructions

Instructions for Form 8038-CP, Return for Credit Payments to Issuers of Qualified Bonds

- Taxes

- English

- Internal Revenue Service

Form 8038-G Instructions

Instructions for Form 8038-G, Information Return for Tax-Exempt Governmental Bonds

- Taxes

- English

- Internal Revenue Service

Form 8038-T Instructions

Instructions for Form 8038-T, Arbitrage Rebate, Yield Reduction, and Penalty in Lieu of Arbitrage Rebate

- Taxes

- English

- Internal Revenue Service

Form 8038-TC Instructions

Instructions for Form 8038-TC, Information Return for Tax Credit Bonds and Specified Tax Credit Bonds

- Taxes

- English

- Internal Revenue Service

Form 8082 Instructions

Instructions for Form 8082, Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR)

- Taxes

- English

- Internal Revenue Service

Form 8233 Instructions

Instructions for Form 8233, Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual

- Taxes

- English

- Internal Revenue Service

Form 8275 Instructions

Instructions for Form 8275, Disclosure Statement

- Taxes

- English

- Internal Revenue Service

Form 8275-R Instructions

Instructions for Form 8275-R, Regulation Disclosure Statement

- Taxes

- English

- Internal Revenue Service

Form 8283 Instructions

Instructions for Form 8283, Noncash Charitable Contributions

- Taxes

- English

- Internal Revenue Service

Form 8288 Instructions

Instructions for Form 8288, U.S. Withholding Tax Return for Dispositions by Foreign Persons of U.S. Real Property Interests

- Taxes

- English

- Internal Revenue Service

Form 8300 Instructions

Instructions for Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business

- Taxes

- Internal Revenue Service

- Spanish

Form 8300 Instructions (Spanish Version)

Instructions for Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business (Spanish Version)

- Taxes

- English

- Internal Revenue Service

Form 8379 Instructions

Instructions for Form 8379, Injured Spouse Allocation

- Taxes

- English

- Internal Revenue Service

Form 843 Instructions

Instructions for Form 843, Claim for Refund and Request for Abatement

- Taxes

- English

- Internal Revenue Service

Form 8582 Instructions

Instructions for Form 8582, Passive Activity Loss Limitations

- Taxes

- English

- Internal Revenue Service

Form 8582-CR Instructions

Instructions for Form 8582-CR, Passive Activity Credit Limitations

- Taxes

- English

- Internal Revenue Service

Form 8594 Instructions

Instructions for Form 8594, Asset Acquisition Statement Under Section 1060

- Taxes

- English

- Internal Revenue Service

Form 8606 Instructions

Instructions for Form 8606, Nondeductible IRAs

- Taxes

- English

- Internal Revenue Service

Form 8609 Instructions

Instructions for Form 8609 , Low-Income Housing Credit Allocation and Certification

- Taxes

- English

- Internal Revenue Service

Form 8609-A Instructions

Instructions for Form 8609-A, Annual Statement for Low-Income Housing Credit

- Taxes

- English

- Internal Revenue Service

Form 8615 Instructions

Instructions for Form 8615, Tax for Certain Children Who Have Unearned Income

- Taxes

- English

- Internal Revenue Service

Form 8621 Instructions

Instructions for Form 8621, Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund

- Taxes

- English

- Internal Revenue Service

Form 8621-A Instructions

Instructions for Form 8621-A, Return by a Shareholder Making Certain Late Elections To End Treatment as a Passive Foreign Investment Company

- Taxes

- English

- Internal Revenue Service

Form 8697 Instructions

Instructions for Form 8697, Interest Computation Under the Look-Back Method for Completed Long-Term Contracts

- Taxes

- English

- Internal Revenue Service

Form 8801 Instructions

Instructions for Form 8801, Credit for Prior Year Minimum Tax„Individuals, Estates, and Trusts

- Taxes

- English

- Internal Revenue Service

Form 8802 Instructions

Instructions for Form 8802, Application for United States Residency Certification

- Taxes

- English

- Internal Revenue Service

Form 8804 Instructions for Schedule A

Instructions for Schedule A (Form 8804), Penalty for Underpayment of Estimated Section 1446 Tax for Partnerships

- Taxes

- English

- Internal Revenue Service

Form 8804-C Instructions

Instructions for Form 8804-C, Certificate of Partner-Level Items to Reduce Section 1446 Withholding

- Taxes

- English

- Internal Revenue Service

Form 8804-W Instructions

Instructions for Form 8804-W (WORKSHEET), Installment Payments of Section 1446 Tax for Partnerships

- Taxes

- English

- Internal Revenue Service

Form 8809-I Instructions

Instructions for Form 8809-I, Application for Extension of Time To File FATCA Form 8966

- Taxes

- English

- Internal Revenue Service

Form 8810 Instructions

Instructions for Form 8810, Corporate Passive Activity Loss and Credit Limitations

- Taxes

- English

- Internal Revenue Service

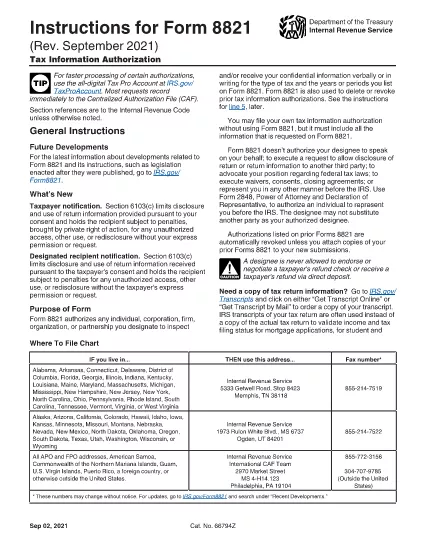

Form 8821 Instructions

Instructions for Form 8821, Tax Information Authorization

- Taxes

- Internal Revenue Service

- Chinese (Traditional)

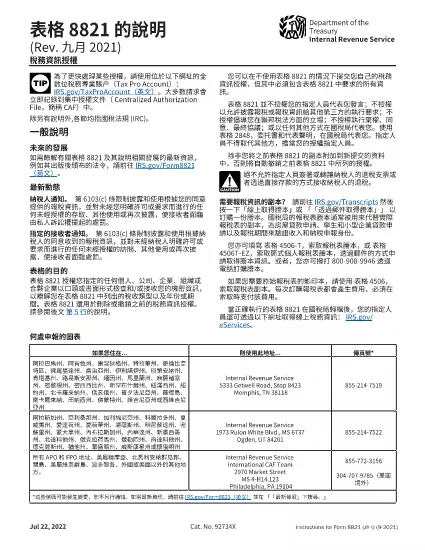

Form 8821 Instructions (Chineze Traditional Version)

Instructions for Form 8821, Tax Information Authorization (Chinese Traditional Version)

- Taxes

- Internal Revenue Service

- Spanish

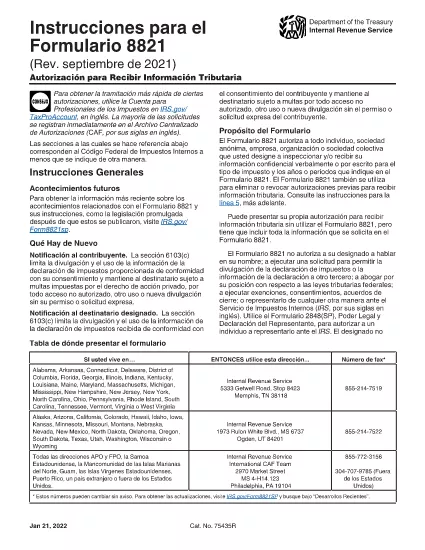

Form 8821 Instructions (Spanish Version)

Instructions for Form 8821, Tax Information Authorization (Spanish Version)

- Taxes

- English

- Internal Revenue Service

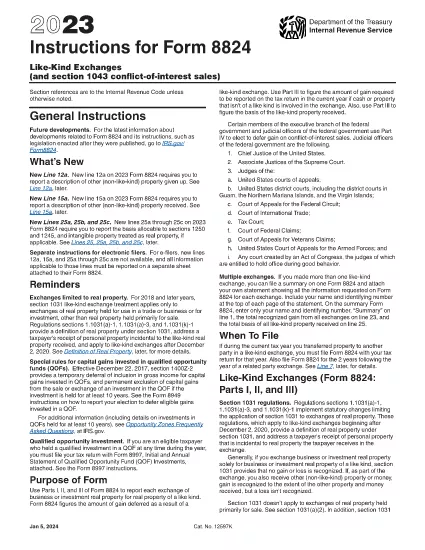

Form 8824 Instructions

Instructions for Form 8824, Like-Kind Exchanges

- Taxes

- English

- Internal Revenue Service

Form 8828 Instructions

Instructions for Form 8828, Recapture of Federal Mortgage Subsidy

- Taxes

- English

- Internal Revenue Service

Form 8829 Instructions

Instructions for Form 8829, Expenses for Business Use of Your Home

- Taxes

- English

- Internal Revenue Service

Form 8835 Instructions

Instructions for Form 8835, Renewable Electricity, Refined Coal, and Indian Coal Production Credit

- Taxes

- English

- Internal Revenue Service

Form 8839 Instructions

Instructions for Form 8839, Qualified Adoption Expenses

- Taxes

- English

- Internal Revenue Service

Form 8844 Instructions

Instructions for Form 8844, Empowerment Zone Employment Credit

- Taxes

- English

- Internal Revenue Service

Form 8845 Instructions

Instructions for Form 8845, Indian Employment Credit

- Taxes

- English

- Internal Revenue Service

Form 8849 Instructions for Schedule 6

Instructions for Schedule 6 (Form 8849), Other Claims

- Taxes

- English

- Internal Revenue Service

Form 8850 Instructions

Instructions for Form 8850, (For use with the March 2016 revision of Form 8850, Pre-Screening Notice and Certification Request for the Work Opportunity Credit)

- Taxes

- English

- Internal Revenue Service

Form 8853 Instructions

Instructions for Form 8853, Archer MSAs and Long-Term Care Insurance Contracts

- Taxes

- English

- Internal Revenue Service

Form 8854 Instructions

Instructions for Form 8854, Initial and Annual Expatriation Statement

- Taxes

- English

- Internal Revenue Service

Form 8857 Instructions

Instructions for Form 8857, Request for Innocent Spouse Relief

- Taxes

- Internal Revenue Service

- Spanish

Form 8857 Instructions (Spanish Version)

Instructions for Form 8857, Request for Innocent Spouse Relief (Spanish Version)

- Taxes

- English

- Internal Revenue Service

Form 8858 Instructions

Instructions for Form 8858, Information Return of U.S. Persons With Respect to Foreign Disregarded Entities (FDEs) and Foreign Branches (FBs)

- Taxes

- English

- Internal Revenue Service

Form 8862 Instructions

Instructions for Form 8862, Information To Claim Certain Credits After Disallowance

- Taxes

- Internal Revenue Service

- Spanish

Form 8862 Instructions (Spanish Version)

Instructions for Form 8862 (sp), Information to Claim Earned Income Credit After Disallowance (Spanish Version)

- Taxes

- English

- Internal Revenue Service

Form 8863 Instructions

Instructions for Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits)

- Taxes

- English

- Internal Revenue Service

Form 8864 Instructions

Instructions for Form 8864, Biodiesel and Renewable Diesel Fuels Credit

- Taxes

- English

- Internal Revenue Service

Form 8865 Instructions

Instructions for Form 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships

- Taxes

- English

- Internal Revenue Service

Form 8865 Instructions for Schedules K-2 and K-3

Instructions for Schedules K-2 and K-3 (Form 8865)

- Taxes

- English

- Internal Revenue Service

Form 8866 Instructions

Instructions for Form 8866, Interest Computation Under the Look-Back Method for Property Depreciated Under the Income Forecast Method

- Taxes

- English

- Internal Revenue Service

Form 8867 Instructions

Instructions for Form 8867, Paid Preparers Due Diligence Checklist for the Earned Income Credit, American Opportunity Tax Credit, Child Tax Credit (including the Additional Child Tax Credit and Credit for Other Dependents), and/or Head of Household Filing Status

- Taxes

- English

- Internal Revenue Service

Form 8869 Instructions

Instructions for Form 8869, Qualified Subchapter S Subsidiary Election

- Taxes

- English

- Internal Revenue Service

Form 8871 Instructions

Instructions for Form 8871, Political Organization Notice of Section 527 Status

- Taxes

- English

- Internal Revenue Service

Form 8872 Instructions

Instructions for Form 8872, Political Organization Report of Contributions and Expenditures

- Taxes

- English

- Internal Revenue Service

Form 8873 Instructions

Instructions for Form 8873, Extraterritorial Income Exclusion

- Taxes

- English

- Internal Revenue Service

Form 8881 Instructions

Instructions for Form 8881, Credit for Small Employer Pension Plan Startup Costs and Auto-Enrollment

- Taxes

- English

- Internal Revenue Service

Form 8883 Instructions

Instructions for Form 8883, Asset Allocation Statement Under Section 338

- Taxes

- English

- Internal Revenue Service

Form 8885 Instructions

Instructions for Form 8885, Health Coverage Tax Credit

- Taxes

- English

- Internal Revenue Service

Form 8886 Instructions

Instructions for Form 8886, Reportable Transaction Disclosure Statement

- Taxes

- English

- Internal Revenue Service

Form 8886-T Instructions

Instructions for Form 8886-T, Disclosure by Tax-Exempt Entity Regarding Prohibited Tax Shelter Transaction

- Taxes

- English

- Internal Revenue Service

Form 8889 Instructions

Instructions for Form 8889, Health Savings Accounts (HSAs)

- Taxes

- English

- Internal Revenue Service

Form 8898 Instructions

Instructions for Form 8898, Statement for Individuals Who Begin or End Bona Fide Residence in a U.S. Possession

- Taxes

- English

- Internal Revenue Service

Form 8900 Instructions

Instructions for Form 8900, Qualified Railroad Track Maintenance Credit

- Taxes

- English

- Internal Revenue Service

Form 8902 Instructions

Instructions for Form 8902, Alternative Tax on Qualifying Shipping Activities

- Taxes

- English

- Internal Revenue Service

Form 8903 Instructions

Instructions for Form 8903, Domestic Production Activities Deduction

- Taxes

- English

- Internal Revenue Service

Form 8904 Instructions

Instructions for Form 8904, Credit for Oil and Gas Production From Marginal Wells

- Taxes

- English

- Internal Revenue Service

Form 8908 Instructions

Instructions for Form 8908, (For use with the February 2020 revision of Form 8908, Energy Efficient Home Credit)

- Taxes

- English

- Internal Revenue Service

Form 8910 Instructions

Instructions for Form 8910, Alternative Motor Vehicle Credit

- Taxes

- English

- Internal Revenue Service

Form 8911 Instructions

Instructions for Form 8911, Alternative Fuel Vehicle Refueling Property Credit

- Taxes

- English

- Internal Revenue Service

Form 8912 Instructions

Instructions for Form 8912, Credit to Holders of Tax Credit Bonds

- Taxes

- English

- Internal Revenue Service

Form 8915-B Instructions

Instructions for Form 8915-B, Qualified 2017 Disaster Retirement Plan Distributions and Repayments

- Taxes

- English

- Internal Revenue Service

Form 8915-C Instructions

Instructions for Form 8915-C, Qualified 2018 Disaster Retirement Plan Distributions and Repayments

- Taxes

- English

- Internal Revenue Service

Form 8915-D Instructions

Instructions for Form 8915-D, Qualified 2019 Disaster Retirement Plan Distributions and Repayments

- Taxes

- English

- Internal Revenue Service

Form 8915-F Instructions

Instructions for Form 8915-F, Qualified Disaster Retirement Plan Distributions and Repayments

- Taxes

- English

- Internal Revenue Service

Form 8918 Instructions

Instructions for Form 8918, Material Advisor Disclosure Statement

- Taxes

- English

- Internal Revenue Service

Form 8928 Instructions

Instructions for Form 8928, Return of Certain Excise Taxes Under Chapter 43 of the Internal Revenue Code

- Taxes

- English

- Internal Revenue Service

Form 8933 Instructions

Instructions for Form 8933, Carbon Oxide Sequestration Credit

- Taxes

- English

- Internal Revenue Service

Form 8936 Instructions

Instructions for Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit (Including Qualified Two-Wheeled Plug-in Electric Vehicles)

- Taxes

- English

- Internal Revenue Service

Form 8936-A Instructions

Instructions for Form 8936-A, Qualified Commercial Clean Vehicle Credit

- Taxes

- English

- Internal Revenue Service

Form 8937 Instructions

Instructions for Form 8937, Report of Organizational Actions Affecting Basis of Securities

- Taxes

- English

- Internal Revenue Service

Form 8938 Instructions

Instructions for Form 8938 , Statement of Specified Foreign Financial Assets

- Taxes

- English

- Internal Revenue Service

Form 8940 Instructions

Instructions for Form 8940, Request for Miscellaneous Determination Under Section 507, 509(a), 4940, 4942, 4945, and 6033 of the Internal Revenue Code

- Taxes

- English

- Internal Revenue Service

Form 8941 Instructions

Instructions for Form 8941, Credit for Small Employer Health Insurance Premiums

- Taxes

- English

- Internal Revenue Service

Form 8949 Instructions

Instructions for Form 8949, Sales and Other Dispositions of Capital Assets

- Taxes

- English

- Internal Revenue Service

Form 8950 Instructions

Instructions for Form 8950, Application for Voluntary Correction Program (VCP) Under the Employee Plans Compliance Resolution System (EPCRS)

- Taxes

- English

- Internal Revenue Service

Form 8952 Instructions

Instructions for Form 8952, Application for Voluntary Classification Settlement Program (VCSP)

- Taxes

- English

- Internal Revenue Service

Form 8955-SSA Instructions

Instructions for Form 8955-SSA, Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits

- Taxes

- English

- Internal Revenue Service

Form 8957 Instructions

Instructions for Form 8957, Foreign Account Tax Compliance Act (FATCA) Registration

- Taxes

- English

- Internal Revenue Service

Form 8959 Instructions

Instructions for Form 8959, Additional Medicare Tax

- Taxes

- English

- Internal Revenue Service

Form 8960 Instructions

Instructions for Form 8960, Net Investment Income Tax„Individuals, Estates, and Trusts

- Taxes

- English

- Internal Revenue Service

Form 8962 Instructions

Instructions for Form 8962, Premium Tax Credit (PTC)

- Taxes

- English

- Internal Revenue Service

Form 8963 Instructions

Instructions for Form 8963, Report of Health Insurance Provider Information

- Taxes

- English

- Internal Revenue Service

Form 8966 Instructions

Instructions for Form 8966, FATCA Report

- Taxes

- English

- Internal Revenue Service

Form 8971 Instructions for Schedule A

Instructions for Form 8971 and Schedule A, Information Regarding Beneficiaries Acquiring Property From a Decedent (For use with Form 8971 (Rev. January 2016))

- Taxes

- English

- Internal Revenue Service

Form 8973 Instructions

Instructions for Form 8973, Certified Professional Employer Organization/Customer Reporting Agreement

- Taxes

- English

- Internal Revenue Service

Form 8974 Instructions

Instructions for Form 8974, Qualified Small Business Payroll Tax Credit for Increasing Research Activities

- Taxes

- English

- Internal Revenue Service

Form 8975 Instructions including Schedule A

Instructions for Form 8975 and Schedule A (Form 8975), Country-by-Country Report

- Taxes

- English

- Internal Revenue Service

Form 8978 Instructions including Schedule A

Instructions for Form 8978 (Including Schedule A), Partners Additional Reporting Year Tax (For use with Form 8978 (Dec. 2019) and Schedule A (Form 8978) (Dec. 2019))

- Taxes

- English

- Internal Revenue Service

Form 8979 Instructions

Instructions for Form 8979, Partnership Representative Revocation, Designation, and Resignation Form

- Taxes

- English

- Internal Revenue Service

Form 8985 Instructions

Instructions for Form 8985, Pass-Through Statement - Transmittal/Partnership Adjustment Tracking Report (Required Under Sections 6226 and 6227)

- Taxes

- English

- Internal Revenue Service

Form 8986 Instructions

Instructions for Form 8986, Partners Share of Adjustment(s) to Partnership-Related Item(s) (Required Under Sections 6226 and 6227)

- Taxes

- English

- Internal Revenue Service

Form 8990 Instructions

Instructions for Form 8990, Limitation on Business Interest Expense Under Section 163(j)

- Taxes

- English

- Internal Revenue Service

Form 8991 Instructions

Instructions for Form 8991, Tax on Base Erosion Payments of Taxpayers With Substantial Gross Receipts

- Taxes

- English

- Internal Revenue Service

Form 8992 Instructions

Instructions for Form 8992, U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (GILTI)

- Taxes

- English

- Internal Revenue Service

Form 8993 Instructions

Instructions for Form 8993, Section 250 Deduction for Foreign-Derived Intangible Income (FDII) and Global Intangible Low-Taxed Income (GILTI)

- Taxes

- English

- Internal Revenue Service

Form 8994 Instructions

Instructions for Form 8994, Employer Credit for Paid Family and Medical Leave (For use with the January 2021 revision of Form 8994)

- Taxes

- English

- Internal Revenue Service

Form 8995 Instructions

Instructions for Form 8995, Qualified Business Income Deduction Simplified Computation

- Taxes

- English

- Internal Revenue Service

Form 8995-A Instructions

Instructions for Form 8995-A, Deduction for Qualified Business Income

- Taxes

- English

- Internal Revenue Service

Form 8996 Instructions

Instructions for Form 8996, Qualified Opportunity Fund

- Taxes

- English

- Internal Revenue Service

Form 926 Instructions

Instructions for Form 926, Return by a U.S. Transferor of Property to a Foreign Corporation

- Taxes

- English

- Internal Revenue Service

Form 934 Instructions (Puerto Rico Version)

Instructions for Form 943 (PR), Employer's Annual Federal Tax Return for Agricultural Employees (Puerto Rico Version)

- Taxes

- English

- Internal Revenue Service

Form 940 Instructions

Instructions for Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return

- Taxes

- Internal Revenue Service

- Spanish

Form 940 Instructions (Puerto Rico Version)

Instructions for Form 940 (PR), Employer's Annual Federal Unemployment (FUTA) Tax Return (Puerto Rico Version)

- Taxes

- Internal Revenue Service

- Spanish

Form 940 Instructions (Spanish Version)

Instructions for Form 940 (sp), Employer's Annual Federal Unemployment (FUTA) Tax Return (Spanish Version)

- Taxes

- English

- Internal Revenue Service

Form 941 Instructions

Instructions for Form 941, Employer's QUARTERLY Federal Tax Return

- Taxes

- English

- Internal Revenue Service

Form 941 Instructions (Puerto Rico Version)

Instructions for Form 941 (PR), Employer's Quarterly Federal Tax Return (Puerto Rico Version)

- Taxes

- Internal Revenue Service

- Spanish

Form 941 Instructions (Spanish Version)

Instructions for Form 941, Employer's QUARTERLY Federal Tax Return (Spanish Version)

- Taxes

- English

- Internal Revenue Service

Form 941 Instructions for Schedule B

Instructions for Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors

- Taxes

- Internal Revenue Service

- Spanish

Form 941 Instructions for Schedule B (Spanish Version)

Instructions for Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors (Spanish Version)

- Taxes

- English

- Internal Revenue Service

Form 941 Instructions for Schedule D

Instructions for Schedule D (Form 941), Report of Discrepancies Caused by Acquisitions, Statutory Mergers, or Consolidations

- Taxes

- English

- Internal Revenue Service

Form 941 Instructions for Schedule R

Instructions for Schedule R (Form 941), Allocation Schedule for Aggregate Form 941 Filers

- Taxes

- English

- Internal Revenue Service

Form 941 Schedule B Instructions (Puerto Rico Version)

Instructions for Schedule B (Form 941) (PR), Report of Tax Liability for Semiweekly Schedule Depositors (Puerto Rico Version)

- Taxes

- English

- Internal Revenue Service

Form 941-SS Instructions

Instructions for Form 941-SS, Employer's QUARTERLY Federal Tax Return„American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands

- Taxes

- English

- Internal Revenue Service

Form 941-X Instructions

Instructions for Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund

- Taxes

- English

- Internal Revenue Service

Form 941-X Instructions (Puerto Rico Version)

Instructions for Form 941-X (PR), Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund (Puerto Rico Version)

- Taxes

- English

- Internal Revenue Service

Form 943 Instructions

Instructions for Form 943, Employer's Annual Federal Tax Return for Agricultural Employees

- Taxes

- Internal Revenue Service

- Spanish

Form 943 Instructions (Spanish Version)

Instructions for Form 943 (sp), Employer's Annual Federal Tax Return for Agricultural Employees (Spanish Version)

- Taxes

- English

- Internal Revenue Service

Form 943 Instructions for Schedule R

Instructions for Schedule R (Form 943), Allocation Schedule for Aggregate Form 943 Filers

- Taxes

- English

- Internal Revenue Service

Form 943-A Instructions

Instructions for Form 943-A, Agricultural Employer's Record of Federal Tax Liability

- Taxes

- Internal Revenue Service

- Spanish

Form 943-A Instructions (Puerto Rico Version)

Instructions for Form 943-A (PR)

- Taxes

- Internal Revenue Service

- Spanish

Form 943-A Instructions (Spanish Version)

Instructions for Form 943-A (sp)

- Taxes

- English

- Internal Revenue Service

Form 943-X Instructions

Instructions for Form 943-X, Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund

- Taxes

- English

- Internal Revenue Service

Form 943-X Instructions (Puerto Rican Version)

Instructions for Form 943-X (PR), Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund (Puerto Rico Version)

- Taxes

- Internal Revenue Service

- Spanish

Form 943-X Instructions (Spanish Version)

Instructions for Form 943-X, Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund

- Taxes

- English

- Internal Revenue Service

Form 944 Instructions

Instructions for Form 944, Employer's ANNUAL Federal Tax Return

- Taxes

- Internal Revenue Service

- Spanish

Form 944 Instructions (Spanish Version)

Instructions for Form 944 (sp), Employer's Annual Federal Tax Return (Spanish Version)

- Taxes

- English

- Internal Revenue Service

Form 944-X Instructions

Instructions for Form 944-X, Adjusted Employer's ANNUAL Federal Tax Return or Claim for Refund

- Taxes

- English

- Internal Revenue Service

Form 944-X Instructions (Spanish Version)

Instructions for Form 944-X (sp), Adjusted Employer's ANNUAL Federal Tax Return or Claim for Refund (Spanish Version)

- Taxes

- English

- Internal Revenue Service

Form 945 Instructions

Instructions for Form 945, Annual Return of Withheld Federal Income Tax

- Taxes

- English

- Internal Revenue Service

Form 945-A Instructions

Instructions for Form 945-A, Annual Record of Federal Tax Liability

- Taxes

- English

- Internal Revenue Service

Form 945-X Instructions

Instructions for Form 945-X, Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refund

- Taxes

- English

- Internal Revenue Service

Form 9465 Instructions

Instructions for Form 9465, Installment Agreement Request (For use with Form 9465 (Rev. September 2020))

- Chinese (Simplified)

- Taxes

- Internal Revenue Service

Form 9465 Instructions (Chinese Simplified Version)

Instructions for Form 9465, Installment Agreement Request (Chinese-Simplified Version)

- Taxes

- Internal Revenue Service

- Chinese (Traditional)

Form 9465 Instructions (Chinese-Traditional Version)

Instructions for Form 9465, Installment Agreement Request (Chinese-Traditional Version)

- Taxes

- English

- Internal Revenue Service

Form 9465 Instructions (Spanish Version)

Instructions for Form 9465 (sp), Installment Agreement Request (Spanish Version)

- Taxes

- English

- Internal Revenue Service

Form 965 Instructions

Instructions for Form 965, Inclusion of Deferred Foreign Income Upon Transition to Participation Exemption System

- Taxes

- English

- Internal Revenue Service

Form 965-A Instructions

Instructions for Form 965-A, Individual Report of Net 965 Tax Liability

- Taxes

- English

- Internal Revenue Service

Form 965-B Instructions

Instructions for Form 965-B, Corporate and Real Estate Investment Trust (REIT) Report of Net 965 Tax Liability and Electing REIT Report of 965 Amounts

- Taxes

- English

- Internal Revenue Service

Form 965-C Instructions

Instructions for Form 965-C, Transfer Agreement Under Section 965(h)(3)

- Taxes

- English

- Internal Revenue Service

Form 965-D Instructions

Instructions for Form 965-D, Transfer Agreement Under Section 965(i)(2)

- Taxes

- English

- Internal Revenue Service

Form 965-E Instructions

Instructions for Form 965-E, Consent Agreement Under Section 965(i)(4)(D)

- Taxes

- English

- Internal Revenue Service

Form 982 Instructions

Instructions for Form 982, Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 1082 Basis Adjustment) (For use with Form 982 (Rev. March 2018))

- Taxes

- English

- Internal Revenue Service

Form 990 Instructions

Instructions for Form 990 Return of Organization Exempt From Income Tax, Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations)

- Taxes

- English

- Internal Revenue Service

Form 990 Instructions for Schedule A

Instructions for Schedule A (Form 990 or Form 990-EZ), Public Charity Status and Public Support

- Taxes

- English

- Internal Revenue Service

Form 990 Instructions for Schedule C

Instructions for Schedule C (Form 990) , Political Campaign and Lobbying Activities

- Taxes

- English

- Internal Revenue Service

Form 990 Instructions for Schedule D

Instructions for Schedule D (Form 990), Supplemental Financial Statements

- Taxes

- English

- Internal Revenue Service

Form 990 Instructions for Schedule F

Instructions for Schedule F (Form 990) , Statement of Activities Outside the United States

- Taxes

- English

- Internal Revenue Service

Form 990 Instructions for Schedule G

Instructions for Schedule G (Form 990) , Supplemental Information Regarding Fundraising or Gaming Activities

- Taxes

- English

- Internal Revenue Service

Form 990 Instructions for Schedule H

Instructions for Schedule H (Form 990), Hospitals

- Taxes

- English

- Internal Revenue Service

Form 990 Instructions for Schedule J

Instructions for Schedule J (Form 990), Compensation Information

- Taxes

- English

- Internal Revenue Service

Form 990 Instructions for Schedule K

Instructions for Schedule K (Form 990), Supplemental Information on Tax-Exempt Bonds

- Taxes

- English

- Internal Revenue Service

Form 990 Instructions for Schedule L

Instructions for Schedule L (Form 990), Transactions With Interested Persons

- Taxes

- English

- Internal Revenue Service

Form 990 Instructions for Schedule R

Instructions for Schedule R (Form 990), Related Organizations and Unrelated Partnerships

- Taxes

- English

- Internal Revenue Service

Form 990-BL Instructions

Instructions for Form 990-BL, Information and Initial Excise Tax Return for Black Lung Benefit Trusts and Certain Related Persons (Use with the December 2013 revision of Form 990-BL)

- Taxes

- English

- Internal Revenue Service

Form 990-EZ Instructions

Instructions for Form 990-EZ, Short Form Return of Organization Exempt From Income Tax Under Section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations)

- Taxes

- English

- Internal Revenue Service

Form 990-PF Instructions

Instructions for Form 990-PF, Return of Private Foundation or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation

- Taxes

- English

- Internal Revenue Service

Form 990-T Instructions

Instructions for Form 990-T, Exempt Organization Business Income Tax Return (and Proxy Tax Under Section 6033(e))

- Taxes

- English

- Internal Revenue Service

Form CT-1 Instructions

Instructions for Form CT-1, Employer's Annual Railroad Retirement Tax Return

- Taxes

- English

- Internal Revenue Service

Form CT-1 X Instructions

Instructions for Form CT-1 X, Adjusted Employer's Annual Railroad Retirement Tax Return or Claim for Refund

- Taxes

- English

- Internal Revenue Service

Form SS-4 Instructions

Instructions for Form SS-4, Application for Employer Identification Number (EIN)

- Taxes

- Internal Revenue Service

- Spanish

Form SS-4 Instructions (Puerto Rico Version)

Instructions for Form SS-4 (PR), Application for Employer Identification Number (Puerto Rico Version)

- Taxes

- Internal Revenue Service

- Spanish

Form SS-4 Instructions (Spanish Version)

Instructions for Form SS-4 (sp), Application for Employer Identification Number (Spanish Version)

- Taxes

- English

- Internal Revenue Service

Form SS-8 Instructions

Instructions for Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding

- Taxes

- Internal Revenue Service

- Spanish

Form SS-8 Instructions (Puerto Rico Version)

Instructions for Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding (Puerto Rico Version)

- Taxes

- Internal Revenue Service

- Spanish

Form SS-8 Instructions (Spanish Version)

Instructions for Form SS-8 (sp), Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding (Spanish Version)

- Taxes

- English

- Internal Revenue Service

Form T Instructions

Instructions for Form T (Timber), Forest Activities Schedule

- Taxes

- English

- Internal Revenue Service

Form W-12 Instructions

Instructions for Form W-12, IRS Paid Preparer Tax Identification Number (PTIN) Application and Renewal

- Taxes

- English

- Internal Revenue Service

Form W-14 Instructions

Instructions for Form W-14, Certificate of Foreign Contracting Party Receiving Federal Procurement Payments

- Taxes

- English

- Internal Revenue Service

Form W-3 Instructions (Puerto Rico Version)

Instructions for Form W-3 (PR), Transmittal of Wage and Tax Statements (Puerto Rico Version)

- Taxes

- English

- Internal Revenue Service

Form W-3C Instructions (Puerto Rico Version)

Instructions for Form W-3C (PR),Transmittal of Corrected Wage and Tax Statements (Puerto Rico Version)

- Taxes

- English

- Internal Revenue Service

Form W-7 Instructions

Instructions for Form W-7, Application for IRS Individual Taxpayer Identification Number (Use with the August 2019 revision of Form W-7)

- Taxes

- English

- Internal Revenue Service

Form W-7 Instructions (Spanish Version)

Instructions for Form W-7 (sp), Application for IRS Individual Taxpayer Identification Number (Spanish version)

- Taxes

- English

- Internal Revenue Service

Form W-7A Instructions

Instructions for Form W-7A, Application for Taxpayer Identification Number for Pending U.S. Adoptions

- Taxes

- English

- Internal Revenue Service

Form W-8BEN Instructions

Instructions for Form W-8BEN, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities)

- Taxes

- English

- Internal Revenue Service

Form W-8BEN-E Instructions

Instructions for Form W-8BEN-E, Certificate of Entities Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities)

- Taxes

- English

- Internal Revenue Service

Form W-8ECI Instructions

Instructions for Form W-8ECI, Certificate of Foreign Person's Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States

- Taxes

- English

- Internal Revenue Service

Form W-8EXP Instructions

Instructions for Form W-8EXP, Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding and Reporting

- Taxes

- English

- Internal Revenue Service

Form W-8IMY Instructions

Instructions for Form W-8IMY, Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting

- Taxes

- English

- Internal Revenue Service

Form W-9 Instructions (Spanish Version)

Instructions for the Requestor of Form W-9 (sp), Request for Taxpayer Identification Number and Certification (Spanish Version)

- Taxes

- English

- Internal Revenue Service

From W-9 Instructions

Instructions for the Requester of Form W-9, Request for Taxpayer Identification Number and Certification

- Taxes

- English

- Internal Revenue Service

Instructions for Forms 1099-QA and 5498-QA

Instructions for Forms 1099-QA and 5498-QA, Distributions From ABLE Accounts and ABLE Account Contribution Information

- Taxes

- Internal Revenue Service

- Spanish

Instructions for Form 1040 Schedule C (Spanish Version)

Instructions for Schedule C (Form 1040), Profit or Loss From Business (Spanish Version)

- Taxes

- Internal Revenue Service

- Spanish

Instructions for Form 1040 Schedule F (Spanish Version)

Instructions for Schedule F (Form 1040), Profit or Loss From Farming (Spanish Version)

- Taxes

- Internal Revenue Service

- Spanish

Instructions for Form 1040 Schedule H (Spanish Version)

Instructions for Schedule H (Form 1040) (sp), Household Employment Taxes (Spanish Version)

- Taxes

- Internal Revenue Service

- Spanish

Instructions for Form 1040 Schedule SE (Spanish Version)

Instructions for Schedule SE (Form 1040), Self-Employment Tax (Spanish Version)

- Taxes

- Internal Revenue Service

- Spanish

Instructions for Form 1040-SS (Spanish Version)

Instructions for Form 1040-SS (sp), U.S. Self-Employment Tax Return (Spanish Version)

- Taxes

- English

- Internal Revenue Service

Instructions for Form 1120-POL

Instructions for Form 1120-POL, U.S. Income Tax Return for Certain Political Organizations

- Taxes

- Internal Revenue Service

- Spanish

Instructions for Form 2290, Heavy Highway Vehicle Use Tax Return (Spanish Version)

Instructions for Form 2290, Heavy Highway Vehicle Use Tax Return (Spanish Version)

- Taxes

- English

- Internal Revenue Service

Instructions for Form 2678

Instructions for Form 2678, Employer/Payer Appointment of Agent

- Taxes

- English

- Internal Revenue Service

Instructions for Form 2848 (Spanish Version)

Instructions for Form 2848 (SP), Power of Attorney and Declaration of Representative (Spanish Version)

- Taxes

- English

- Internal Revenue Service

Instructions for Form 4626

Instructions for Form 4626, Alternative Minimum Tax„Corporation

- Taxes

- English

- Internal Revenue Service

Instructions for Form 7204

Instructions for Form 7204, Consent To Extend the Time To Assess Tax Related to Contested Foreign Income Taxes„Provisional Foreign Tax Credit Agreement

- Taxes

- English

- Internal Revenue Service

Instructions for Form 7205

Instructions for Form 7205, Energy Efficient Commercial Buildings Deduction

- Taxes

- English

- Internal Revenue Service

Instructions for Form 7206

Instructions for Form 7206, Self-Employed Health Insurance Deduction

- Taxes

- English

- Internal Revenue Service

Instructions for Form 7207

Instructions for Form 7207, Advanced Manufacturing Production Credit

- Taxes

- English

- Internal Revenue Service

Instructions for Form 7210

Instructions for Form 7210, Clean Hydrogen Production Credit

- Taxes

- English

- Internal Revenue Service

Instructions for Form 7213

Instructions for Form 7213, Nuclear Power Production Credit

- Taxes

- English

- Internal Revenue Service

Instructions for Form 8814

Instructions for Form 8814, Parents' Election to Report Child's Interest and Dividends

- Chinese (Simplified)

- Taxes

- Internal Revenue Service

Instructions for Form 8862 (Chinese Simplified Version)

Instructions for Form 8862, Information to Claim Earned Income Credit After Disallowance (Chinese-Simplified Version)

- Taxes

- Internal Revenue Service

- Chinese (Traditional)

Instructions for Form 8862 (Chinese-Traditional Version)

Instructions for Form 8862 (zh-t), Information to Claim Earned Income Credit After Disallowance (Chinese-Traditional Version)

- Taxes

- English

- Internal Revenue Service

Instructions for Form 8868

Instructions for Form 8868, Application for Extension of Time To File an Exempt Organization Return or Excise Taxes Related to Employee Benefit Plans

- Taxes

- English

- Internal Revenue Service

Instructions for Forms W-2G and 5754

Instructions for Forms W-2G and 5754, Certain Gambling Winnings and Statement by Person(s) Receiving Gambling Winnings

- Taxes

- English

- Internal Revenue Service

Instructions for Forms 1094-B and 1095-B

Instructions for Forms 1094-B and 1095-B

- Taxes

- English

- Internal Revenue Service

Instructions for Forms 1094-C and 1095-C

Instructions for Forms 1094-C and 1095-C

- Taxes

- English

- Internal Revenue Service

Instructions for Forms 1096, 1097, 1098, 1099, 3921, 3922, 5498, and W-2G

General Instructions for Certain Information Returns, (Forms 1096, 1097, 1098, 1099, 3921, 3922, 5498, and W-2G)

- Taxes

- English

- Internal Revenue Service

Instructions for Forms 1098-E and 1098-T

Instructions for Forms 1098-E and 1098-T, Student Loan Interest Statement and Tuition Statement

- Taxes

- English

- Internal Revenue Service

Instructions for Forms 1099-A and 1099-C

Instructions for Forms 1099-A and 1099-C, Acquisition or Abandonment of Secured Property and Cancellation of Debt

- Taxes

- English

- Internal Revenue Service

Instructions for Forms 1099-INT and 1099-OID